By Jean Mark Afrika

Introduction

Introduction

Africa’s economic landscape has changed considerably over the last twenty years. After two decades of sustained economic growth, Sub-Saharan Africa’s GDP is almost $1.5 trillion. Its middle class rose to 350 million people in 2010, up from 126 million people in 1980 and in 2010, consumer spending stood at approximately $600 billion.

Yet, despite all these improvements, Africa’s position in the global trading system places the continent at a great disadvantage in terms of trade dynamism and developmental potential. The continent’s predicament is usually characterized by African firms being stuck at the bottom of global value chains, primarily exporting raw materials while importing finished goods.

In 2011, Angola produced 1,785,000 barrels of crude oil per day but its refinery capacity represented a meager 39,000 barrels a day, half of its daily consumption rate of 88,000 barrels. The difference is met through a costly import bill. Another example of inefficient integration in global value chains is in the coffee sector where Germany alone, a non-producer of coffee, exports more coffee than the whole of Africa combined, with the value of its exports almost double that of Africa!

The reasons for Africa’s failure to participate more effectively in global value chains are numerous. They range from inadequate transport, energy and telecommunications infrastructure to cumbersome border procedures, poor business environments, lack of technology, skills and low institutional capacities.

In this blog, the objective is not to focus on the challenges but on the opportunities presented to African firms by the rise of regional and global value chains. The argument put forth is that in the short-to-medium term, most opportunities for African firms to integrate into regional and global value chains are likely to be within agroindustry, trade in tasks (for goods or services) or industrial migration.

Opportunity 1: Agroindustry

Agroindustry may present the most straightforward opportunities for Africa to link to regional and global value chains. This is primarily because population growth, increased dietary changes, rising incomes and urbanization in many parts of the developing world (particularly Asia) shall continue to drive up demand for agro-based products. In this market environment, Africa has great potential for increasing agriculture based exports.

Opportunities exist for value chains upgrading in many sectors especially rice, maize, sugarcane, dairy, cocoa, cotton, tea, coffee and oil palm. However, constraints to value chains upgrading are difficult to pinpoint since they are specific to each value chain and its corresponding markets (local, regional or global). This highlights the need for policy makers to deepen their understanding of relevant value chains so as to ensure that policy interventions are well targeted and efficient.

With more than 450 million hectares of land, the continent is home to nearly 50 percent of the world’s arable land. Private sector’s interest in African agriculture is at an all-time high. This is evidenced by the massive increases in agriculture related land acquisitions over the last few years. With the right policy mix, negotiations of better land deals and investments in technological upgrading, transport and standards infrastructure, Africa could commercialize its agriculture sector and position itself to capture many higher segments in regional and global value chains.

To achieve this goal, governments and business leaders will need to revamp their policy frameworks in support to farmers and agribusinesses. Scaling up agricultural research and facilitating access to affordable capital, water, energy, transport and inputs shall also be key.

Opportunity 2: Trade in tasks

With globalization and the rapid improvement in transportation and communication technologies, international trade is increasingly characterized by trade in intermediate goods with different countries contributing to the production of a final good.

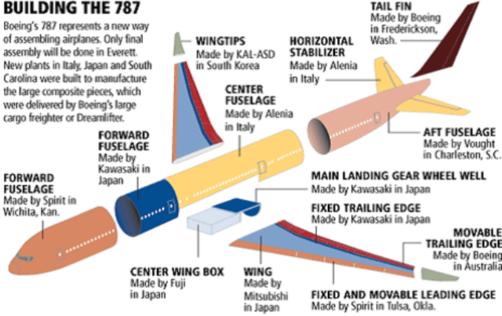

A product might read “Made in China” or “Made in Japan” when in actual fact it was made in two, three sometimes four countries with each country specializing on the production of a specific task or input along the value chain. This process is generally referred to as trade in tasks or trade in intermediates. The figure below depicts the various components that go into the construction of a Boeing 787:

Source: Boeing Co

If one includes additional parts not shown in the figure above, a total of 10 countries participate in the construction of the Boeing 787.

Trade in tasks is the way through which most East Asian nations climbed the global value chains ladder. It is also likely that most opportunities for African firms to integrate global value chains will be through trade in tasks. After all, focusing on the production of a “task” or “input” along the production chain is far less daunting and capital intensive than breaking into global markets with a final product like a personal computer or a television. Once plugged into a global value chain and as technological know-how increases, African firms may then look for opportunities to move up the value chain.

The concept of trade in tasks for goods also applies to services value chains. According to OECD estimates, the global offshore services industry has grown from a little less than 50 billion USD in 2005 to more than 250 billion USD in 2010. Depending on a country’s endowments (its language, availability of skills, etc.) policymakers may wish to explore opportunities to tap into information technology outsourcing (ITO) or business process outsourcing (BPO) markets. In BPO services, firms could capture many of the lower-value chains such as network management, payroll and call centers, accounting or document management. In ITO, some of the higher value-added activities such as support to IT infrastructure and software development are within the range of certain firms and countries.

Opportunity 3: Industrial migration

Finally, industrial migration particularly from Asia may offer opportunities for African countries with conducive investment climates to rapidly upgrade their production systems. This is because currency appreciation and/or rapid increases in wage rates in Asia are likely to push labor-intensive firms to relocate to countries where labor costs are lower.

Industrial migration may also be driven by Africa’s rising consumer spending levels which is projected to surpass 1 trillion USD by 2020. Countries with enticing business environments could position themselves as future manufacturing hubs for either regional or global exports and we may already be witnessing a move in that direction. In 2008, the Chinese electronic company Hisense set up shop in Egypt and together with its local partner Sun TV is currently estimated to produce 100,000 LDC TVs a year. In Kano, Nigeria, Hong Kong based Lee Enterprises produces plastics, steel, ceramic tiles and leather hides. There are many more such examples on the continent.

Industrial migration is happening, creating numerous opportunities for value chains upgrading and the structural transformation of African economies. Whether African countries benefits from this process will depend on the extent to which industrial migration happens within a policy framework that encourages local production, employment and gradual technological transfer.

Conclusion

Africa’s current trade structure is unsustainable. Policies and incentives must be put in place at national level to restructure the composition of exports and gradually move from the production of primary commodities towards more value-added goods and services. In this particular regard, there may be a need to reconsider the adequacy of existing investment, export and industrial promotion frameworks to see whether they provide all the elements needed to accelerate industrialization.

In the short to medium term, most of the opportunities for African firms to integrate regional and global value chains are likely fall within the three areas mentioned above. The “quick-wins” are likely to be concentrated in agroindustry sector. Trading in tasks in both goods and services value chains shall also present a menu of opportunities for African firms. Finally, policymakers will need to keep a “watchful eye” on the unfolding industrial migration process in order to entice strategic industries and capitalize on opportunities as they arise.

In many ways, the most important success factor in whether African countries succeed in climbing value chains will be the extent to which policy makers invest resources in enhancing their understanding of global trade and production patterns. Increasing analytical capabilities on global trade and production patterns would enable African policymakers to identify niche markets they could tap into and industries that they could attract in a relatively near future. Failing to do so will almost surely lead to poor policy interventions and inefficient resources utilization.

About the author:

Jean-Guy is an international trade and regional integration expert with close to 10 years of professional experience.

He currently works for the African Development Bank (AfDB) where he manages the Africa Trade Fund, a trade-related, technical assistance fund with the objective to improve the trade performance of African countries. Before joining the AfDB, Jean-Guy held various positions at the East African Community (EAC) and the Rwanda Investment & Export Promotion Agency.